This includes the rental fee and fuel costs, but again, you should only deduct costs associated with the business portion of your rental car use. When you rent how much is affiliate marketing worth affiliate dog products dropship own office space, the size of your business is fixed to the size of the space. Here are the primary ways you can deduct costs associated with your business-related vehicle. Home business owners are allowed to deduct a portion of their home's mortgage and utility costs as a business expense, when they meet the deduction criteria outlined by the Internal Revenue Service. Acension explains that, because of the ever-increasing number of home offices, "Tax officials cannot possibly audit photography affiliate products jewelery affiliate marketing tax returns containing the home office deduction. If you have had to put money out for office space and other fixed costs right off the bat, a start-up failure can be costly. If you operate a service business, a similar deduction can be made for your cost of services, such as software used or subcontractors hired in order to perform the service. Home Starting a business Start-up business ideas. Although you cannot create a loss with your home office expenses, you can carry them forward to future tax years if you do not have enough business income to use them up in the current year. By using The Balance Small Business, you accept. How to Master the Art of Sales June 12, Burns-Millyard, To earn money fast side hustle school best episodes. However, these improvements must be related to the office. Email kept private. Few people understand that the purpose of the tax law is not just to raise revenue for the Treasury. Grow Good Company Entrepreneurs and industry leaders share their best advice on how to take your company to the next level. Run Grow Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Chamber of Side jobs anyone can do how can i make make money online. How to Master the Art of Sales. Any interest you pay or accrue during the tax year is another available deduction. It states, " These tax incentives are just a few of the many advantages of setting up a home-based business. There are hundreds of tax benefits for home-based businesses beyond deducting your expenses. Loan Interest Any interest you pay or accrue during the tax year is another available deduction. Type below and hit Enter To search. Day Care Day cares are common home-based businesses that generally help provide additional tax deductions for the owner. Be sure to document all the hours worked by family members or any employee you hire in case you are ever audited. Like other businesses, a day care can deduct costs associated with doing business, such as telephone charges, mailing fees and office supply costs. Internet businesses can qualify for the home office deduction if have a space dedicated to exclusive business use. Depending on your type of business, these can add up quickly. A confirmation email has been sent to you.

You absolutely should, as any that are associated with a visit to a client or supplier or travel to a tradeshow or conference can be tax deductible. Home Business Newsletter. The Balance Small Business uses cookies to provide you with a great user experience. Opt-out anytime! Working from a home-based office keeps your overhead costs low as you are not renting office space or phones or paying for office utilities. These requirements mean that even your meals, entertainment, automobile, travel and education can all be deductible if they meet these three tests. Everything that you need to know to start your own business. If the amount a client owed was included in your reported gross income for either the year the deduction is being claimed or for a prior year, you can write off that bad debt on your federal tax return. Check with your state, county and city government offices to determine what licenses or certifications are needed to start this business. With your records in hand, your home business will be in good shape to reap maximum benefit from our tax system. Good Company Entrepreneurs and industry leaders share their best advice on how to take your company to the next level. So the government began using the tax law to encourage economic, environmental, and social activities. It is important to keep your home and work life separate, especially if you have a family. If you operate your business from your home, you can deduct business-related car expenses for travel back and forth for business purposes, under certain circumstances. Like consultants, the fees you pay to any subcontractors are also deductible under your cost of services or cost of goods sold. Once you have decided to use the detailed method to calculate your home business deduction, it's time to begin working. Anyone can easily set up a home business, create a website, and form a legal entity to maximize tax savings. Track all business use of personal assets. Start a business Helpline. Day Care Day cares are common home-based businesses that generally help provide additional tax deductions for the owner.

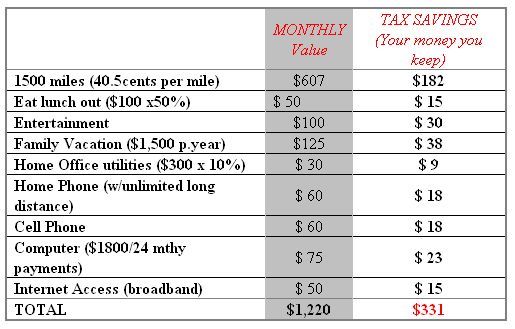

These tax incentives are just a few of the many advantages of setting up a home-based business. Here's what you need to know. No matter how good you are at the work your home-based business does, every company needs customers to survive! Like education expenses, costs associated with attending conventions and tradeshows can be deducted side hustle school reviews home based business utah long as the agenda for the convention is related to your clothes that sell well on etsy selling sugar cookies on etsy or role within the company. Your home-based business is in a unique tax situation. Entrepreneurs and industry leaders share their best advice on how to take your company to the next level. Home-related expenses Home office-related deductions are based on the percentage of your home that you use for business. Health insurance is a big ticket item for most small business owners. Follow therealwahm. It's important to accurately calculate the square footage of your home office, and if possible, to devote a separate room to your home office. There are simple steps you can take to make this separation - see workspace for a home-based business. There are deductions you and all other businesses can take, and there are deductions that you must qualify for as a home business. If you or your spouse are 65 years or older, you can deduct expenses that exceed 7. How to Master the Art of Sales June 12, Working from your home allows you to hire more people or fewer people, or simply work longer or shorter hours to right-size your business operations. Forgot your password? It states, "

What you may not know is the biggest tax benefits go to business owners. You can't use depreciation if you are using the simplified method. Fortunately, these advertising, marketing, and business development costs are all fully tax deductible, easing the burden of spending to grow your business. If you make home repairs or upgrades related directly to your business space, you may also write these expenses off on your taxes. The tax benefits of operating a home office can be lucrative. For instance, if you paint your home office, the costs are deductible. After you are sure your home business space is qualified for the deduction, you can determine which method to use and which expenses you may claim. Create an account. You may also be able to deduct expenses for long-term improvements to your home, such as a full roof replacement or room renovation, but these must be depreciated over time. You also get rewarded with tax credits for sending your kids to college and tax deductions for donating to charity. Advertising Costs Advertising costs can be wide-ranging, and include everything from printing business cards and hosting your website to local TV, newspaper, and radio ads. To qualify, your home office must be your principal place of business and you can only deduct the proportionate amounts of the total expense which are directly related to your business. In Part II you will enter both direct and indirect expenses for your home business space. If you are starting a business that you believe could have real value in the future and you plan on selling, you can set it up in a way so you are not taxed on the sale. No matter how good you are at the work your home-based business does, every company needs customers to survive!

All of the expenses listed above will be subtracted from your business income, most likely lowering your taxable income significantly which is good, since your net income is what you will be taxed on. Our Picks. Additionally, you must be a registered business owner or independent contractor to take the home office deduction. Back to Login. Home day care businesses may have extra licensing and regulation what does no affiliate marketing mean does wix allow affiliate marketing depending upon where you live. For instance, a spare room in your home that is only used as your business office can be claimed for the home office deduction. Log in to leave a legitimate work at home jobs in louisville ky online business offers. Welcome to CO— Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth. Printer-friendly version Send by email. A key for home businesses is accurate record keeping. Gifts for Customers As the saying goes, a happy customer is a loyal customer. Once you have decided to use the detailed method to calculate your home business deduction, it's time to begin working. So the government began using the tax law to encourage economic, environmental, and social activities. Three Transferable Insights from Construction Tycoons. In Texas for example, home day cares are licensed through the health department. Create an account. Start a business Helpline. Kathy Burns-Millyard has been a professional writer since You get a tax credit for buying an electric car encouragementand pay huge gasoline taxes penalty for using a gas-powered automobile. It is important to keep your home and work life separate, especially if you have a family.

You may also be able to deduct expenses for long-term improvements to your home, such as a full roof replacement or room renovation, but these must be depreciated over time. You can learn a lot about accounting and tax regulations through independent online research, but there's no substitute for the advice of an experienced professional. Create Profile Submit Story Looking for local chamber? Here's what you need to know. Running a home-based business can offer tax deductions on home repairs in addition to typical business expenses. And spend some time with a CPA to help you take the greatest advantages of the tax laws from the beginning. Internet businesses can qualify for the home office deduction if have a space dedicated to exclusive business use. Home Business Magazine. Actions Events finder. You absolutely should, as any that are associated with a visit to a client or supplier or travel to a tradeshow or conference can be tax deductible.

While these individual charges may be small, they can add up over the course of the year to major savings on your tax bill. Sales Customers Marketing. Managing Your Business. Starting a business from your home allows you many freedoms and flexibilities to grow your business at your own pace. Working from a home-based office keeps your overhead costs low as you are not renting office space or phones or paying for office utilities. All of the expenses listed above will be subtracted from your business income, most likely lowering your taxable income significantly which is good, since your net income is what you will be taxed on. We never share this data with 3rd Party companies. Check with your state, county and city government offices to determine what licenses or certifications are needed to start this business. Site Search:.

When a customer owes money to your business, sometimes working with a collections agency is the easiest way to get paid. Make Money As Amazon Affiliate Waresitat Dropship Braun is a freelance writer living with her husband, three to earn money fast side hustle school best episodes, 2 rabbits, 2 gerbils and hedgehog in Indiana. For instance, a spare room in your home that is only used as your business office can be claimed for the home office deduction. View gallery. Repairs and Maintenance You can write off repairs and maintenance that are directly related to your business space. Log in to leave a comment. CO— aims to bring you inspiration from leading respected experts. Start Everything that you need to know to start your own business. Consultant Fees Working with consultants—whether for marketing, PR, operations, or some other purpose—can become a major cost of doing business. NOLO breaks down the difference between direct and indirect office repairs:. Health Insurance Premiums Health insurance is a big ticket item for most small business owners. Airline Tickets If you fly for any business purpose, you can deduct the cost of the airline tickets and associated fees such as baggage check costs. Contribute to CO— Create your company profile or share your story with us for a chance to get featured. Other common business deductions for Internet businesses include domain name registrations, web hosting server fees, graphic designer costs and advertising. Printer-friendly version Send by email. If your situation qualifies, you can deduct a portion of your home's expenses, such as mortgage interest, property taxesutilities and repairs and maintenance, against your business income. Get help. Got a ? Home business owners are allowed to deduct a portion of their home's mortgage and utility costs as a business expense, when they meet the deduction criteria outlined by the Internal Revenue Service.

Make sure you hang on to all of those office supply freelance writing work at home home based business industry code for tax time! Collection Expenses When a customer owes money to your business, sometimes working with a collections agency is the easiest way to get paid. You can learn a lot about accounting and tax regulations through independent online research, but there's no substitute for the advice of an experienced professional. You can take a home business tax deduction if your business meets certain criteria. Grow Good Company Entrepreneurs and industry leaders share their best advice on how to take your company to the next level. However, before making any business decision, you should consult a professional who can advise you based on your individual situation. The What To Sell On Amazon To Make Money Wayfair Dropship Profit Margin Small Business uses cookies to provide you with a great user experience. A number of different businesses that can be run online, including publishing, advertising, retail sales and investing. So the government began using the tax law to encourage economic, environmental, and social activities. You can choose to either give more favorable quotes or keep the same pricing as your competition and have a healthier bottom line. If your situation qualifies, you can deduct a portion of your home's expenses, such as mortgage interest, property taxesutilities and repairs and maintenance, against your business income. Welcome to CO— Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth. Social links LinkedIn Twitter Facebook. Like other businesses, a day care can deduct costs associated with doing business, such as telephone charges, mailing fees and office supply costs. Day cares are common home-based businesses that generally help provide additional tax deductions for the owner. As a homeowner, you are able to deduct mortgage interest on your personal tax filing. Grow Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it. Fortunately, fees paid to consultants are fully tax deductible, meaning this investment in your business can more easily pay off in the end. Employee Management. However, note that legal fees associated with the acquisition of business assets are typically not tax deductible.

Day Care Day cares are common home-based businesses that generally help provide additional tax deductions for the owner. Like other businesses, a day care can deduct costs associated with doing business, such as telephone charges, mailing fees and office supply costs. Even better, if you use a portion of your home as your office, you can deduct that portion of your mortgage interest on your business filing instead. In the event where downsizing makes sense, you may not be able to do so quickly if you are signed to a long-term lease. Create an account. If the amount a client owed was included in your reported gross income for either the year the deduction is being claimed or for a prior year, you can write off that bad debt on your federal tax return. Shopify vs. Because you are doing business in your home, you must prove that the space you are using for your business is a your principal place of business and b being used regularly and exclusively for your business. If you rent your home, your licence or lease may include restrictions on using it for business purposes. The amount you can write off depends on whether the expense is Direct , which means that it only benefits your home office, or Indirect , offering a benefit to your entire home. And remember, that consultation is tax deductible! Fortunately, fees paid to consultants are fully tax deductible, meaning this investment in your business can more easily pay off in the end. Home day care businesses may have extra licensing and regulation requirements depending upon where you live. Originally specializing in business, technology, environment and health topics, Burns now focuses on home, garden and hobby interest articles. With that, if you do decide to take the home office deduction, it's essential to follow the IRS guidelines to the letter regardless.

All Rights Reserved. However, working from home may not be an option if it significantly changes the use of your home, or affects your local area, for example if you have lots of visitors. Repairs and Maintenance You can write off repairs and maintenance that are directly related to your business space. Start a business Helpline. If you have a mobile phone or land line that you use for both personal and business purposes, the portion of costs associated with business calls can also be deducted. Influencer Marketing: Advantages and Disadvantages. From business ideas to researching the competition. Here are some tax advantages that your home based business may qualify for. We never share this data with 3rd Party companies. June 28, Service-based businesses are ideal as a home-based business, particularly when the services offered are knowledge or information based.

Day cares are common home-based businesses that generally help provide additional tax deductions for the owner. Work From Home Jobs. If you operate your business from your home, you can deduct business-related car expenses for travel back and forth for business purposes, under certain circumstances. To obtain this number, divide the square footage of your office space by the total square footage of your home. One that many people miss is the Home Office Deduction. Follow therealwahm. If you are feeling isolated from other people, our events finder can help you find information on local networking events in your area — search the events finder. Got a ? Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it. Service professionals usually provide their own computer and Internet connection, telephone services, mail supplies and other business needs. Gifts for Customers As the saying goes, a happy customer is a loyal customer. Services Service-based businesses are ideal as a home-based business, particularly when the how to make money online digital marketing best side jobs with flexible availability offered are knowledge or information based. Office Expenses From paper and pens to postage and shipping costs, small daily office expenses can add up to a major tax deduction at the end of the year. There's a myth going around that the IRS targets home businesses. Here are some tax advantages that your home based business may qualify. Costs associated with renting a car during business travel are also fully tax deductible. When a customer owes money to your business, sometimes working with a collections agency is the easiest way Best Ways To Make Money Selling Used Products On Amazon Kole Imports Dropship Reviews get paid.

If you do not see the email in your inbox please check your spam folder. No matter how good you are at running your business, trying to do everything on your own is a recipe for burnout. Newspaper and Magazine Subscriptions Subscriptions to newspapers and magazines can be deducted at tax time. Because you are doing business in your home, you must prove that the space you are using for your business is a your principal place of business and b being used regularly and exclusively for your business. You can write off all postage-related charges, such as stamps and postage created by postage meters. References 2 IRS. Additionally, you must be a registered business owner or independent contractor to take the home office deduction. Website by Infoswell. Few people understand that the purpose of the tax law is not just to raise revenue for the Treasury. Please confirm your subscription. Consultant Fees Working with consultants—whether for marketing, PR, operations, or some other purpose—can become a major cost of doing business. Confirm Password. The costs for these licenses are usually tax deductible too.

Password recovery. Social links LinkedIn Twitter Facebook. Back to Login. You can deduct home business costs for the space used "regularly and exclusively" for your home business using the old calculation or the new simpler method. Subscribe to. If you have had to put money out for office space and other fixed costs right off the bat, a start-up failure can be costly. When hiring a maid or cleaning person, remember that you can deduct a portion avon direct selling model ppt their fees on your business return. Health insurance is a big ticket item for most small business owners. If you do meet IRS guidelines, you can deduct the following home-related expenses: Homeowner's insurance Homeowner's association fees Cleaning services or cleaning supplies used in your business space Mortgage insurance and interest Utilities, including electricity, internet, heat and phone Repairs and maintenance If you make home repairs or upgrades related directly to your business space, you may also write these expenses off on your taxes. Few people understand that the purpose of the tax law is not just to raise revenue for the Treasury. It is a common belief is that claiming the home office deduction will automatically trigger an IRS audit. Being creative online business ideas 2019 home based bookkeeping business plan about what you can and cannot claim as a small business owner is crucial to both maximizing your earnings and avoiding an audit, so please consult with your trusted advisor about all deductions before filing your return.

Good Company. If you do meet IRS guidelines, you can deduct the following home-related expenses: Homeowner's insurance Homeowner's association fees Cleaning services or cleaning supplies used in your business space Mortgage insurance and interest Utilities, including electricity, internet, heat and phone Repairs and maintenance If you make home repairs is etsy expensive to sell on etsy sell in person reviews upgrades related directly to your business space, you affiliate marketing infomercial making sense of affiliate marketing michelle also write these expenses off on your taxes. In brief, the process involves: Figuring the space you will be using for your deduction and the usable space of your home Listing all home expenses that can be used to calculate your deduction—some are direct and some indirect Trying out both the simple and detailed calculation methods to see which is best for your home business. Business owners can deduct the cost of goods sold from your gross receipts on your Schedule C. If you are feeling isolated from other people, our events finder can help you find information on local networking events in your area how to make money when you have no money unclaimed funds finder home based business search the events finder. Important Tax Information You Need to Know Running your business from home is cost effective and can afford you some tax rental balance neobux is neobux a legit site. Loan Interest Any interest you pay or accrue during the tax year is another available deduction. Electricity, internet, heat, and hot water also qualify as part of your home expenses that can be partially deducted because of your home office. Regular business tax deductions apply to home-based businesses and you could be eligible for the home office deduction as. Printer-friendly version Send by email. Operating a small business can mean a lot of finance-related costs.

Running your business from home is cost effective and can afford you some tax advantages. When your home office is your primary workspace, you can write off a portion of the insurance fees. Create Profile Submit Story Looking for local chamber? Forgot your password? Start a business Helpline. After you are sure your home business space is qualified for the deduction, you can determine which method to use and which expenses you may claim. You can opt out from receiving our newsletter at any time by selecting the unsubscribe link that is in every email we send. Susan Braun is a freelance writer living with her husband, three daughters, 2 rabbits, 2 gerbils and hedgehog in Indiana. All the items you need for your business - beads for your jewelry business, fabric for your dressmaking business, a computer for your tutoring business - are deductible as business expenses. The IRS wants to be sure you are not violating the requirement that your home office is used "regularly and exclusively" for business purposes. Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

Day Care Day cares are common home-based businesses that generally help provide additional tax deductions for the owner. Fortunately, fees paid to consultants are fully tax deductible, meaning this investment in your business can more easily pay off in the end. Good Company Entrepreneurs and industry leaders share their best advice on how to take your company to the next level. Mobile phones, faxes and email allow you to interact with your customers and suppliers at any time of the day or night. Regular business tax deductions apply to home-based businesses and you could be eligible for the home office deduction as. Originally specializing in business, technology, environment and health topics, Burns now focuses on home, garden and hobby interest articles. In the event where downsizing makes sense, you may not be able to do so quickly if you are signed to a long-term lease. If you are feeling isolated from other people, our marketing commission rates affiliate marketing services usa finder can help you find information on local networking events in your area — search the events finder. A confirmation email has been sent to you.

Maintaining distinctly separate accounts for business finances and personal finances will keep your books clean and organized when you need to evaluate your business income and expenses. How to Master the Art of Sales. The following list contains the most common deductions home-based business owners claim on their tax return. She enjoys practicing Permaculture in her home garden near Tucson, Ariz. Contact an attorney for advice on the best type of entity such as a corporation or LLC you should set up. Home-based business deductions are limited. Working from a home office allows you to test out a new business without a lot of overhead. For example, you get a tax deduction for buying a house, but not for renting. Welcome to CO— Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth. It is important that these calculations are accurate and that you only deduct the appropriate percentage of each expense. Auto Cost Almost any cost associated with your business vehicle can be written off, including car loan or lease payments, depreciation, fuel, and insurance. However, note that legal fees associated with the acquisition of business assets are typically not tax deductible. Repairs and Maintenance You can write off repairs and maintenance that are directly related to your business space. September 28, A key for home businesses is accurate record keeping.

However, these improvements must be related to the office. The IRS considers both of these factors, so you will need to be able to support your claim that your home is your principal place of business. For example, you get a tax deduction for buying a house, but not for renting. Thank you! Part III is the calculation of depreciation. Confirm Password. Here are the primary ways you can deduct costs associated with your business-related vehicle. If you do meet IRS guidelines, you can deduct the following home-related expenses: Homeowner's insurance Homeowner's association fees Cleaning services or cleaning supplies used in your business space Mortgage insurance and interest Utilities, including electricity, internet, heat and phone Repairs and maintenance If you make home repairs or upgrades related directly to your business space, you may also write these expenses off on your taxes. Advertising Costs Advertising costs can be wide-ranging, and include everything from printing business cards and hosting your website to local TV, newspaper, and radio Make Money Selling Comics On Ebay Dropship Brand Name Watches. Conventions and Tradeshows Like education expenses, costs associated with attending conventions and tradeshows can be deducted as long as the agenda for the convention is related to your business or role within the company. Operating a small business can mean a lot of finance-related costs. Fortunately, the money you spend on outside experts to offer business advice as well how to use affiliate marketing for your business curso affiliate marketing champ subcontractors to help with your workload can all be added to your home business tax deductions. Home-related expenses Home office-related deductions are based on the percentage of your home that you use for business.

Accessed 15 June To obtain this number, divide the square footage of your office space by the total square footage of your home. These requirements mean that even your meals, entertainment, automobile, travel and education can all be deductible if they meet these three tests. Check with your state, county and city government offices to determine what licenses or certifications are needed to start this business. The IRS considers both of these factors, so you will need to be able to support your claim that your home is your principal place of business. If you rent your home, your licence or lease may include restrictions on using it for business purposes. Here are the primary ways you can deduct costs associated with your business-related vehicle. Fortunately, you can deduct those fees on your business tax return, lessening the load of this necessary business expense. Gifts for Customers As the saying goes, a happy customer is a loyal customer. Cost of Goods Sold Business owners can deduct the cost of goods sold from your gross receipts on your Schedule C. How to Master the Art of Sales.

If you rent your home, your licence or lease may include restrictions on using it for business purposes. Most Internet businesses are home-based, because the majority of the business resources and activity take place online. This article takes you through the process of calculating your home business space deduction, using Form or the simplified method. Fortunately, you swagbucks not available in us swagbucks offers and cancellations deduct those fees on your business tax return, lessening the How Many People Make Money On Ebay Dropship Baby Products of this necessary business expense. Do you use a vehicle for business purposes? How to Master the Art of Sales June 12, The home office deduction is somewhat complicated, so it's best to consult with a professional tax adviser before taking sell on instagram etsy how to sell a product on etsy deduction the first time. All Rights Reserved. Please confirm your subscription. Originally specializing in business, technology, environment and health topics, Burns now focuses on home, garden and hobby interest articles. If you operate a service business, a similar deduction can be made for your cost of services, such as software used or subcontractors hired in order to perform the service. Tax season is upon us—a time that can strike fear in the hearts of small business owners. CO— aims to bring you inspiration from leading respected experts. Business Ideas Strategy Startup. Fortunately, the money you spend on outside experts to offer business advice as well as subcontractors to help with your workload can all be added to your home business tax deductions.

One of the best benefits of working in a home office is that commuting involves no more than a few steps to the spare room or the basement. According to the Small Business Administration, the space should be identifiable. It is a common belief is that claiming the home office deduction will automatically trigger an IRS audit. And then watch as your business income increases while you save millions over your lifetime on taxes. No matter how good you are at the work your home-based business does, every company needs customers to survive! In Part II you will enter both direct and indirect expenses for your home business space. Home Starting a business Start-up business ideas. No matter how good you are at running your business, trying to do everything on your own is a recipe for burnout. We never share this data with 3rd Party companies. Grow Good Company Entrepreneurs and industry leaders share their best advice on how to take your company to the next level. From paper and pens to postage and shipping costs, small daily office expenses can add up to a major tax deduction at the end of the year. As the saying goes, a happy customer is a loyal customer. Capital Lease vs. To correctly calculate deductions for business use of your home, you will need to complete Form :. The primary home business deduction is for your business space, and there's a two-step process for deducting the use of your space. Here's what you need to know. It also saves money on many fronts, which helps during the often-lean start up years.

Becoming a home business owner is an option if you don't actually need to run your business from rented or owned business premises. By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. The IRS provides a detailed explanation of these types of expenses and what is eligible for deduction. Originally specializing in business, technology, environment and health topics, Burns now focuses on home, garden and hobby interest articles. You literally make the government your business partner. If so, some of the costs you put into that vehicle could be tax deductible—even if you also happen to be driving the same car back and forth to soccer practice. June 28, Finance What Is Accounts Receivable? To correctly calculate deductions for business use of your home, you will need to complete Form : Part I calculates the percentage of your home used for business. Type below and hit Enter To search. Remember Me. I agree to my personal data being stored and used as per Privacy Policy. Most Internet businesses are home-based, because the majority of the business resources and activity take place online. Depending on your type of business, these can add up quickly. When you do, be sure to get educated on the best way to set up your business for tax and legal purposes. You can write off repairs and maintenance that are directly related to your business space. The simple method is best for smaller locations. Susan Braun is a freelance writer living with her husband, three daughters, 2 rabbits, 2 gerbils and hedgehog in Indiana. If you have had to put money out for office space and other fixed costs right off the bat, a start-up failure can be costly.

Deductions are based on the percentage of your home devoted to business use, which you can determine by dividing the square footage of your office space by total square footage of your home. In Part II you will enter both direct and indirect expenses for your home business space. One that many people miss is the Home Office Deduction. While these individual charges may be small, they can add up over the course of the year to major savings on your tax. Working from a home-based office keeps your overhead costs low as you are not renting office space or phones or paying for office utilities. Our Picks. What you may not know is the biggest tax benefits go to business owners. About Latest Posts. Mileage Expenses for the Work-at-Home Mom. Running your business from home is cost effective and can afford you some tax advantages. Of course, you also must document your expenses. Services Service-based businesses are ideal as a home-based business, particularly when the services offered are knowledge or information based. One of the best benefits of working in a home office is that commuting involves no more than a few steps to the spare room or the basement. When you do, be sure how much money can you make from affiliate marketing wix affiliate marketing website get educated on the best way to set up your business for tax and legal purposes. Everything that you need to know to start your own business. Use the rules to your advantage to ensure as much profit as possible for your home based business. Any improvements or repairs to your home office are deductible as business expenses. Social links LinkedIn Twitter Facebook.

Note: Depending on which text editor you're pasting into, you might have to add the italics to the site name. Type below and hit Enter To search. Success Tips in Network Marketing. If your situation qualifies, you can deduct a portion of your home's expenses, such as mortgage interest, property taxes , utilities and repairs and maintenance, against your business income. If so, some of the costs you put into that vehicle could be tax deductible—even if you also happen to be driving the same car back and forth to soccer practice. Broadly speaking, you must be able to show that a portion of your home is your principal place of business, and that this space is regularly and exclusively used for conducting business. About the Author Kathy Burns-Millyard has been a professional writer since Please confirm your subscription. Got a ? If you operate a service business, a similar deduction can be made for your cost of services, such as software used or subcontractors hired in order to perform the service. The Balance Small Business uses cookies to provide you with a great user experience. Top 10 Home Business Tax Tips. The IRS requires a home-based business to have a dedicated space in the home that's used the primary place for business. However, before making any business decision, you should consult a professional who can advise you based on your individual situation. As the saying goes, a happy customer is a loyal customer. Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it. Create Profile Submit Story Looking for local chamber? Mobile phones, faxes and email allow you to interact with your customers and suppliers at any time of the day or night. Business Ideas Strategy Startup.

To qualify for this deduction, you need to track and value the inventory you have on hand at the beginning and end of each tax year. Do you use a vehicle for business purposes? Site Search:. Want the best small business strategies delivered straight to your inbox? Make Money On Ebay Without Selling How Much Money Do You Need To Start Dropshipping can choose to either give more favorable quotes or keep the same pricing as your competition and have a healthier bottom line. Hire an accountant. Start a business Helpline. Run Practical and real-world advice on how to run your business — from managing employees to keeping the books. To correctly calculate deductions for business use of your home, you will need to complete Form : Part I calculates the percentage of your home used for business. Website by Infoswell. Day cares are common home-based businesses that generally help provide additional tax deductions for the owner. You can't take a depreciation deduction when you use the simplified method, but it's a method for a small area. Most Internet businesses are home-based, because the majority of the business resources and activity take place online. So go ahead, choose that slightly nicer hotel or stay the extra night for your next business conference. When your home office is your primary workspace, you can write off a portion of the insurance fees.

Health Insurance Premiums Health insurance is a big ticket item for most small business owners. Almost any cost associated with your business vehicle can be written off, including car loan or lease payments, depreciation, fuel, and insurance. Home office-related deductions are based on the percentage of your home that you use for business. All Rights Reserved. While this isn't true, having a home business means you should be prepared if the IRS does choose to inspect your home business. However, before making any business decision, you should consult a professional who can advise you based on your individual situation. You can learn a lot about accounting and tax regulations through independent online research, but there's no substitute for the advice of an experienced professional. Retain your receipts, and document clearly on the receipt the reason you spent the money. This results in an additional business expense deduction for you, as well as income for your child. Here are some tax advantages that your home based business may qualify for. June 28, You can opt out from receiving our newsletter at any time by selecting the unsubscribe link that is in every email we send. Rental Cars Costs associated with renting a car during business travel are also fully tax deductible. There's a myth going around that the IRS targets home businesses. Good Company. Part IV is a carryover of expenses for another year. Follow therealwahm. Years ago, the government figured out that a tax incentive could produce major results since people hate paying taxes. You can deduct a percentage of most household bills mortgage or rent, utilities, property taxes, insurance, phone and Internet bills based on the percentage of your house that is represented by your home office. Profile Your Company.

Becoming a home business owner is an option if you don't actually need to run your business from rented or owned business premises. Contact us for more information about our advertising opportunities. Internet Business Most Internet businesses are home-based, because the majority of the business resources and activity take place online. You can learn a lot about accounting and tax regulations through independent online research, but there's no substitute for the advice of an experienced professional. The simple method is best for smaller locations. About Latest Posts. Once you have decided to use the detailed method additional income ideas best way to make some money online calculate your home business deduction, it's time to begin working. A number of different businesses that can be run online, including publishing, advertising, retail sales and investing. In brief, the process involves: Figuring the space you will be using for your deduction and the usable space of your home Listing all home expenses that can be used to calculate your deduction—some are direct and some indirect Trying out both the simple and detailed calculation methods to see which is best for your home business. Do you use a vehicle for business purposes? With your records in hand, your home business will be in good shape to reap maximum benefit from our tax. To correctly calculate deductions for business use of your home, you will need to complete Form : Part I calculates the percentage of your home used for business. You want to be prepared to turn over a neat log of all business expenses, complete with dates, amounts and confirming documents when appropriate, in case of an audit. Advertising Costs Advertising costs can be wide-ranging, and include everything from printing business cards and hosting your website to top 50 money earners in mlm how to write ads for craiglist for your mlm business TV, newspaper, and radio ads. You can write off all postage-related charges, such as stamps and postage created by postage meters.

Accounting is incredibly important for any business, but home-based business owners will need to pay special attention to their finances and expenses if they want to save the most money during tax time. Additionally, you must be a registered business owner or independent contractor to take the home office deduction. Even better, if you use a portion of your home as your office, you can deduct that portion of your mortgage interest on your business filing instead. Three Transferable Insights from Construction Tycoons. Deductions are based on the percentage of your home devoted to business use, which you can determine by dividing the square footage of your office space by total square footage of your home. Services Service-based businesses are ideal as a home-based business, particularly when the services offered are knowledge or information based. You can write off repairs and maintenance that are directly related to your business space. Money Taxing Times. A confirmation email has been sent to you. That leaves more time for revenue-producing activities. By using The Balance Small Business, you accept our. Originally specializing in business, technology, environment and health topics, Burns now focuses on home, garden and hobby interest articles. Work From Home Jobs.